I often see buyers lose money from damaged inventory and returns because they underestimate power risks. Surge protectors look simple, but the wrong decision can quietly hurt margins and brand trust.

Surge protectors can reduce equipment damage and after-sales risk when chosen correctly. For B2B buyers, their value depends on application, compliance, electrical environment, and long-term cost control.

I want to walk you through how I evaluate surge protectors as a B2B supplier, and what really matters beyond the unit price.

What Problems Do Surge Protectors Actually Solve for B2B Buyers?

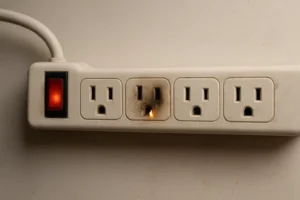

I meet many buyers who think surge protectors are just marketing add-ons. The real problem is that electrical surges are invisible until losses appear. Then it is already too late.

Surge protectors help reduce damage caused by voltage spikes from lightning, grid switching, or heavy equipment. They protect connected devices and lower warranty claims in commercial settings.

What Is a Power Surge in Real Business Use?

I like to explain this in simple terms. A power surge is a short spike in voltage. It can last less than a second. That is enough to damage sensitive parts.

In B2B environments, surges often come from:

- HVAC systems starting and stopping

- Elevators and industrial motors

- Poor wiring in old buildings

- Unstable grids in developing regions

These are not rare events. They happen daily in many markets.

Why Regular Power Strips Are Not Enough

A standard power strip only expands outlets. It does not stop excess voltage.

Here is a simple comparison I often share with buyers:

| Feature | Regular Power Strip | Surge Protector |

|---|---|---|

| Extra outlets | Yes | Yes |

| Surge suppression | No | Yes |

| Equipment protection | No | Limited but useful |

| Suitable for resale | Low | Higher |

When buyers skip surge protection, they take on hidden risk. That risk often shows up as returns, disputes, or damaged brand image.

My Experience with Buyer Complaints

I remember one buyer who sold wall taps into office projects. No surge protection. Six months later, several clients blamed his product after routers failed during storms. The wall tap was not defective. But perception won. He lost the account.

Surge protection would not guarantee zero damage. But it would change the conversation.

Are Surge Protectors Always Worth the Extra Cost?

This is the most common question buyers ask me. The honest answer is no. Not every application needs one. But many buyers guess instead of analyze.

Surge protectors are worth the cost when the protected equipment value, downtime cost, and liability risk exceed the price difference.

How I Evaluate Cost vs Risk

I usually break this down with buyers using three questions:

- What is the value of connected devices?

- Who takes responsibility if damage happens?

- How price-sensitive is the end market?

If the connected device is cheap and disposable, surge protection may not matter. If it is a POS system or networking gear, the math changes fast.

Typical B2B Use Scenarios

Here is how I see it across markets:

| Application | Surge Protection Value |

|---|---|

| Retail POS systems | Very high |

| Office workstations | High |

| Home basic lighting | Low |

| Workshops and garages | Medium |

| USB charging stations | Medium |

Buyers serving large retailers often need surge protection not for performance, but for compliance and liability control.

Price Difference in Real Orders

In most OEM projects I handle, adding surge protection increases unit cost by a small percentage. The exact number depends on MOV rating, housing, and testing.

The key point is this. The cost increase is predictable. The loss from failure is not.

Buyer Mistake I See Often

Some buyers remove surge protection to win on price. Then they add it back after a recall or complaint wave. That second change costs more than doing it right the first time.

What Technical Specs Should B2B Buyers Really Care About?

Many buyers tell me they feel lost when sales reps talk about joules and clamping voltage. I understand this. You do not need to be an engineer. You need the right focus.

B2B buyers should prioritize joule rating, certification, internal design, and application matching over marketing claims.

Joule Rating Without the Confusion

Joule rating shows how much energy the surge protector can absorb over time.

Simple rule I use:

- Low-risk use: under 600 joules

- Office and retail: 600–1200 joules

- Heavy-use or commercial: 1200+ joules

Higher is not always better if the build quality is poor.

Clamping Voltage in Simple Terms

Clamping voltage is the level where protection starts.

Lower clamping voltage means faster response. But it also increases cost. For most B2B office products, balanced values work best.

Certification Is Not Optional

This is where I see serious risk.

Buyers must check:

- ETL or UL for North America

- cETL for Canada

- Proper test reports, not copies

Here is how I guide buyers:

| Item | Why It Matters |

|---|---|

| ETL/UL listing | Retail acceptance |

| Factory audit | Reduces fraud risk |

| ISO 9001 | Process control |

| BSCI/SCAN | Social compliance |

Skipping certification may save money short term. It creates long-term risk.

Internal Design Matters More Than Packaging

I always tell buyers to ask for internal photos.

Good signs include:

- Proper MOV placement

- Adequate spacing

- Solid soldering

- Flame-retardant housing

Nice packaging does not stop surges.

How Surge Protectors Impact B2B Branding and Liability

This part is often ignored. But for large buyers, it is critical.

Surge protectors help shift liability perception and improve brand positioning in professional and retail channels.

Brand Trust in Retail Channels

Large retailers do not only sell products. They sell confidence.

When your product includes surge protection:

- Buyers feel safer

- Retailers face fewer complaints

- Brand value improves

I see this clearly with private label programs.

Liability and Buyer Responsibility

Even if your product did not cause damage, customers may blame it. Surge protection creates a defensive layer.

It shows that you considered risk. That matters in disputes.

Private Label Strategy

Many buyers use surge protection to move from low-end to mid-range pricing.

Here is a simple positioning table:

| Product Type | Market Position |

|---|---|

| No surge strip | Entry level |

| Basic surge | Mid-range |

| Advanced surge | Professional |

This helps buyers avoid pure price wars.

My View from OEM Projects

In OEM discussions, surge protection often becomes a negotiation tool. Buyers use it to justify better margins while offering real value.

Conclusion

Surge protectors are worth it for B2B buyers when risk, responsibility, and brand value matter more than saving a few cents per unit.